ANSWERS

FIXING THE BANKING SYSTEM FOR GOOD

Real Money Economics is an economic theory which proposes to change the current monetary and fractional reserve banking system as follows:

- change the bank depository and payment system to a "Trust Banking System";

- change the bank credit system to a mutual fund system;

- to keep price stability, change the new money creation system from a deposit creation system as follows:

- create a new entity owned by Treasury to be in charge of this, under the control of the Federal Reserve Bank, but not owned by it;

- increase the money supply by a modified Taylor Rule

- grant the resulting seigniorage to Treasury thus paying off the national debt and greatly lowering taxes.

This process consists of both a transition and a steady-state economic plan:

1) The Transition: from the current fractional reserve banking system using a modified version of the proposal [1] urged by Irving Fisher during the height of the Great Depression (often called the Chicago Plan) and recommended by 235 economists of the time [2]. A recent working paper by members of the Research Department of the International Monetary Fund has updated and tested this on the US economy (The Chicago Plan Revisited, 2012, updated 2013 [3] ). The transition will be over a weekend with banks closed. (see details below)

2) The Steady State operations after the transition will be "Limited Purpose Banking [4]" as outlined by Laurence Kotlikoff, formerly on the (US) President's Council of Economic Advisers. (see details below)

Background

The term Real Money Economics was first used in reference to the composite of material presented at a conference at the Federal Reserve Bank of Philadelphia on April 17, 2013 called Fixing the Banking System for Good. Speakers in order of appearance were: Introduction by Herb Taylor, Executive Vice-President, Federal Reserve Bank of Philadelphia; David Kotok, Cumberland Advisors; Michael Kumhof, International Monetary Fund; Prof. Laurence Kotlikoff, Boston University; Prof. Jeffrey Sachs, Columbia University; Lord Adair Turner, Financial Services Authority (Britain); William Poole, former President, Federal Reserve Bank of St. Louis, and Uli Kortsch, Global Partners Investments. The term Real Money Economics is meant to denote the difference between the fractional money held in banks today versus the complete or "real money" which would be in accounts under this system.

In order to properly understand the solutions which Real Money Economics proposes it is necessary to first have a review of the current system and understand its ramifications.

Fractional Reserve Banking

A. Overview

The fractional reserve banking system is used in every major country in the world with the preponderance of new money created by the use of banks making loans. This process creates new money as the loans made do not come from previous deposits – as is normally thought by most – but instead by what is called "deposit creation". This is the process whereby a bank creates a deposit in the borrower's account ex nihilo limited only by the national requirements on "reserves". The volume of this new money is indirectly controlled by the national central bank (e.g., the Federal Reserve Bank in the case of the US) through the setting of interest rates which are meant to set the speed of new debt creation and thereby also new money creation, e.g., as interest rates are raised, fewer new loans are made and therefore less new money is being created.

Under our current banking system, when a depositor deposits funds in a bank, that money does not belong to the depositor anymore but rather now to the bank and is exchanged for an IOU guaranteeing repayment when demanded. This banker-customer relationship is most aptly categorised as a debtor/creditor-type relationship and not, as is often thought of as the case, a trustee-beneficiary relationship.[5] It is important to reflect upon the distinction between the two. If banks were considered trustees over depositor deposits, the banks could not profit (earn interest on the loans arising out of deposit creation activities (discussed below)) without accounting to the depositor for that profit. Equally, a depositor would have a proprietary claim against the bank for the deposit in the event of insolvency. This is not the case with our current banking system. When a deposit is made, 'ownership and control' transfers to the bank in consideration for an agreement to repay the depositor the deposit (with or without interest) either on demand or at a fixed or determinable time.[6] The depositor has no claim on the deposit beyond this 'promise to repay'.[7]

Under a complex series of rules, the bank needs to hold only about 10% of its depository base in reserve, being the cash it holds in its vault plus deposits at the Central Bank (the Federal Reserve Bank in the US). Thus if a deposit is made of $1,000, the bank could in principle make $10,000 worth of loans – in actual fact the situation is a bit more complicated for any individual bank as there are thousands of banks – but for the system as a whole, that is true. Where does the bank get the other $9,000 -- from deposit creation. It is this lack of the cash to return the other 90% if demanded, that creates runs on banks.

B. Deposit Creation

When a bank wishes to make a loan to someone, it simply creates the amount of the loan in that individual's account, which is called deposit creation. The bank only needs 10% of the loan as reserve and is totally balanced by this action. For example, to make a $10,000 loan, it needs $1,000 in reserves and then creates a $10,000 loan contract, which is an asset, and a $10,000 deposit, which is a liability – and everything is balanced.

This demonstrates the fact that banks do not intermediate funds [8], because to do so, a depositor would first have to deposit funds in the bank which it would then intermediate on to borrowers. In fact the exact opposite happens, which is that the borrower comes first, signs a loan contract, which then creates the needed deposit to balance the bank's books.

C. Bank Runs

Under our current fractional reserve banking system a deposit made at a bank constitutes a liability to the bank, as the bank now has the obligation to repay that deposit to the depositor when demanded (called a "demand deposit"). However, until demanded back, the bank has a largely free hand as to how to use that deposit in order to make a profit from it. The bank therefore converts the short-term deposit into a long-term asset, usually by issuing a loan to a borrower or buying Treasuries with it. This is a central purpose of financial intermediation: it allows the time horizons of depositors to differ from the time horizons of borrowers. However, when this time conversion is misallocated, a bank run results, as the bank is not able to liquidate its assets at the same rate as depositors now wish to have their funds returned to them. The bank is then declared insolvent even though technically it may still have more assets than liabilities. This problem is inherent in the very nature of the system itself and governmental regulation attempts to minimize these occurrences.

As a result of this structure, thousands of banks have failed in the US. For a complete list since 2000 (and a list of those before is also available) see the Federal Deposit Insurance Corporation's listing. Most of the problems currently faced by the Eurozone can be attributed to the same issue, as the various governments were unable to keep their banks liquid with normal actions and so needed to resort to sovereign guarantees which were beyond the capacity of many of the countries to honor. The economy of Iceland collapsed for the same reason in 2008.

D. Banking Regulatory Regime

The current banking system is inherently unstable due to the role of banks in the time conversion of demand deposits (see Bank Runs above). In order to create stability, governments have created multiple layers of security around banks to forestall bank runs. These involve depository guarantee schemes usually paid by banks themselves, such as the Federal Deposit Insurance Corporation in the US, to the recent TARP payments with taxpayer monies (in the US), to the promise by the European Central Bank's Chief Mario Draghi "to do whatever is necessary [9]" to protect the Euro by keeping banks liquid. The quid pro quo in this is a heavy hand at bank regulation, such that in the US there are over 100 governmental bank regulatory bodies to which banks need to answer. A recent article in the Economist states that Wells Fargo Bank alone receives an average of 5000 legal orders per week [10].

E. Pro-cyclicality

As new money is created through the granting of loans and more loans are obviously desired and granted when the economy is booming, this means that the creation of new money is maximized during boom times, adding even further fire to the roaring economy. This leads to inflation and so the central bank will raise interest rates in order to slow down new loan creation. When the economy falters, the exact opposite happens. This means that the current system automatically amplifies the strength of business cycles, making the booms bigger and the busts deeper, leading to planning difficulties, labor participation rate variability and increasing bankruptcies.

F. Deleveraging Economy

When an economy as a whole is overly indebted, most entities attempt to unwind their debts simultaneously creating a deleveraging economy with a resultant recession or even depression. This process of attempted aggregate deleveraging is internally inconsistent for 2 reasons: first, the normal process for both companies and individuals is to maximize income to pay the debt down, but this is impossible, if all actors are simultaneously seeking this same solution. The second reason is that as debts are either paid off or written off, a portion of the money is destroyed (due to it having been created through deposit creation in the first place), which reduces currency in circulation and normally also its velocity. The normal reaction of central banks is to reduce interest rates to the very bottom (but they cannot go negative, due to the "zero-bound") [11], in order to stimulate loan creation, but this is referred to as "pushing on a string", as no one wants to take on new debt but all are instead trying to delever. As seen by the experience of Japan, this process can create economic stagnation lasting for multiple decades!

G. Quantitative Easing (QE) and its Effectiveness

Under normal monetary conditions, new money is not created by central banks, but rather by the private banking system, as explained above. When the deposit creation system fails to generate the needed systemic liquidity (such as in a deleveraging economy as noted above), the central banks can and often do step in. Normally this is done by providing high powered money (see below) as deposits in the Central Bank in a particular private bank's account in order to engender loan creation capacity by that bank. This assumes that there are ready, willing, and able borrowers for new loans which would then create the extra needed liquidity. These extra deposits are normally done by central banks purchasing Treasuries, GSE debt (usually just called agency debt), or other assets on the secondary market. Over the last several years the Federal Reserve Bank has printed about 2.5 trillion dollars worth and is currently creating a further $85B per month by purchasing mostly agency debt. The argument in favor of this is not that it has produced a reasonable recovery, but rather that this action has stopped a second Great Depression.

Thus the purpose of QE is to increase money in circulation in the general economy through two primary methods: the first by increasing bank reserves and the second by lowering interest rates. Securities (mostly agency debt) are purchased on the secondary market banks and exited to the Central Bank. However, the effectiveness of this decreases the longer the program operates. The reason is that, QE only increases bank reserves and not actual money in circulation, which is created through bank loans. Why? Well, despite the increase in system liquidity, and the co-extensive increase in the capacity of banks to lend money - the theoretical money multiplier [12] effect - in a deleveraging scenario, economic entities (borrowers) are not interested in taking out new loans. The absence of borrowers abrogates the theoretical money multiplying effect of QE - the liquidity is not getting to end users and the real economy. This is referred to as a "liquidity trap". The ineffectiveness of QE in a deleveraging system is recounted by some senior economists in the US: stating (as recent as mid 2013) that the multiplier in the US is close to zero. [13]

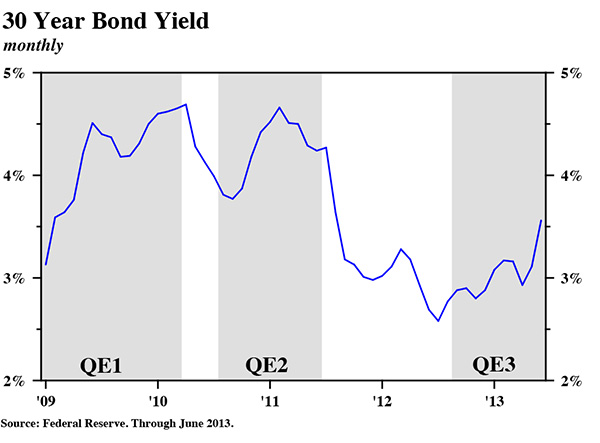

The second purpose, being to lower interest rates in general, is also thwarted by the expectation of continuing Central Bank action."The effect of each of the [recent] quantitative easings was the opposite of the Fed's intentions. During every period of balance sheet expansion long rates rose, yet when securities purchases were discontinued yields fell (see chart below). The Fed cannot control long rates because long rates are affected by inflation expectations, not by supply and demand in the market place. This is extremely counter intuitive. With more buying, one would assume that prices would rise and thus yields would fall, but the opposite occurred. Why? When the Fed buys, it appears that the existing owners of Treasuries (now amounting to $9.5 trillion) decide that the Fed's actions are inflationary and sell their holdings, raising interest rates. When the Fed stops this program, inflation expectations fall creating a demand for Treasuries, bringing rates back down. The Fed's quantitative policies have been counter productive to growth as interest rates have risen during each period of quantitative easing. During QE1 and QE2, commodity prices rose, the dollar fell and inflation rose temporarily. Wages, however, did not respond. Thus, the higher interest rates during all QEs and the fall in the real wage income during QE1 & QE2 served to worsen the income and wealth divide. This means many more households were hurt, rather than helped, by the Fed's efforts." [14]

H. High Powered Money

This is the reserve capital of banks (and thus the monetary base) and is called high powered, as theoretically it can be multiplied through the loan-making activities of private banks. It can be arbitrarily increased by the Central Bank through the creation of deposits in its accounts with member banks.

I. Seigniorage

Seigniorage is the difference between the cost of creating money and its actual value, e.g., if it costs 1¢ to print a $1 bill, then the seigniorage is 99¢. Currently most seigniorage goes to banks indirectly through deposit creation. It is only indirect, as the created funds are again liquidated when the loan is paid off or discharged. This means that the banks receive the net interest differential on the seigniorage for the term of the loan created through deposit creation. In effect this is a tax on the rest of the economy and transferred to the banks. In return for this extraordinary privilege, banks have to pay for the costs of regulation. There is argument today whether these two factors cancel each other out or even if banks lose in this equation.

I. Governmental Debt

The federal government's budget is paid for by general tax income (including fees, licenses, etc) + the income from the sale of Treasuries + minor excess profits from the Federal Reserve Bank. As the creation of new money has been allocated to the private banks, they have been given the right to lend some of that back to the government at interest. Further, because an increase in the money supply for the sake of price stability demands an increase in aggregate debt, much of that debt has been created by both federal and state governments. In mid 2013, the US total federal debt stood at about $16.5T but GDP = $15.8T [14]. This does not include state debts nor the unfunded liabilities of Social Security, Medicare, Medicaid. Under the current monetary system continuing high deficits will increase this debt load.

Real Money Economics: The Details and Results

Real Money Economics proposes to instill hard ethics into the current monetary system and not just prescribe more regulations meant to firm up an internally unstable system. The solution presented only involves 2 fundamental steps outlined below under A. and B..

A. Trust Banking System

Under this system, banks would be divided into 2 totally separate parts or "windows", one being the trust depository side and the other the credit side (lending and investments). In effect this could be called "Glass-Steagall on steroids".

1. Depository or Payment Window

In a Trust Banking System when a normal deposit is made at a bank into the depositor's account, the funds would continue to belong to the depositor (versus exchanged for an IOU as under the current system) and the bank is simply given instructions by the depositor as to what to do with the money, e.g., when a check is presented for payment, it will be paid. This would all be covered under the standard depository agreement between the bank and the customer. 100% of the depository base will at all times be covered by cash in the vault or deposits at the Fed. The only source of income for a bank from the Depository Window would be fees for services. No deposit creation would exist in this system and thus no new money created by private banks. Further, because all deposits would at all times be fully covered, the needed oversight would be minimized as the system is autonomously stable.

2. Credit or Investment Window

Under the Trust Banking System banks would become true intermediaries (as most think that banks are today) and offer loans and other investment products from those with cash wishing to have it invested. This would be done through the Credit Window of banks but none of the funds under the Depository Window would be available for this purpose. Instead, savers and investors would subscribe to a series of offered mutual funds in say, car loans, or mortgages, or commercial loans of various kinds, and so on. These could be open or close-ended funds as desired with maturities, risk levels, and return levels published by the bank in advance. Thus credit would now be driven by savings rather than the arbitrary increase (or decrease) of high powered money and deposit creation. Savers would again be rewarded for savings and interest rates would be controlled by the market rather than largely by Fed edict and actions as now. A more complete description of this is found under Limited Purpose Banking [15].

B. Monetary Commission

1. Steady State Operations

It is generally agreed by economists that both inflation and deflation are bad for the economy, but that price stability is optimal. The reason that the Fed and most other central banks aim for a 2% inflation is that their tools become largely ineffective as the inflation rate approaches 0% and especially in a deflationary economy due to the"zero bound" (see above). This means that there needs to be a mechanism whereby the currency in circulation grows at the same rate as the economy as a whole -- this is currently accomplished through the creation of debt by private banks. Under a Trust Banking System this is no longer possible and therefore an independent mechanism needs to be created.

For instance, if there were 1 house in the economy and $100,000 in circulation that house could only have a maximum value of $100,000. If a second house were to be built, each house could now have a maximum value of only $50,000 unless there was a mechanism whereby an additional $100,000 could be injected into the economy.

The Austrian School of Economics attempts to do this through linking the currency in circulation to a commodity, such as gold. One of the major difficulties with this approach is that the currency in circulation will vary every year depending on the amount of gold held by the central bank, which in the very long run, will vary by the amount mined and not used for other purposes. Economics teaches us that either the price or the volume can be controlled, but not both simultaneously. This means that in any given year either inflation or deflation could exist and planning becomes very difficult.

Under Real Money Economics new money would be created by an entity owned by Treasury but operated by the Federal Reserve Bank. This means that 100% of the seigniorage would accrue to the citizens at large as income in some combination to both federal and state governments. A recent bill in Congress (HR 2990 [112th]) [16] suggested that 25% be devoted to state budgets, allocated according to population. This would be used for some combination of reducing taxes, reducing the deficit, and improving government services. This means that the benefit of new money creation would now accrue to all citizens instead of only to private banks.

The rate of new money creation would be according to a hard set mechanical rule and publicly verifiable. It can be viewed as a modified Taylor Rule, but the Fed as operators of the Monetary Commission would no longer need to forecast economic activity but could use recent past changes in GDP as a yardstick and obviously not use interest rates as inexact monetary aggregate change driver.

2. The Transition

Currently in the Fractional Reserve Banking System about 10% of the depository aggregate is held by American banks as reserves in vault cash plus deposits at the Fed. This means that in order to convert to the Trust Banking System the banks would need a replenishment of the remaining 90%. This is held in good paper, consisting of personal and corporate loans as well as Treasuries. There are a number of ways to do this, but one of the simplest would be for the Monetary Commission to monetize (i.e., "print" in paper and electronic currency) this 90% and move it into the banks by purchasing the 90% of the banking assets not in reserves. All of the banking assets monetized which remain "in Trust" (i.e., in the Depository Window) would create no inflation as the value is already in the overall economic system. The Fed would stipulate a report from all banks shortly after the Transition and monetarily sterilize all the funds which had moved into the Credit Window resulting in no change to money in circulation. This would also be an excellent way for the Fed to reduce its currently overwhelming balance sheet of about $3.5T, mostly created in the years 2009 to 2013.

The value of the 90% not held in reserves is about $18T and thus with the current US federal debt of ~$16.5T (mid 2013) the Federal Government would become an instant creditor and not debtor nation. All of this could be done over a weekend but planned well in advance. The Monetary Commission would then divide the bought banking assets into classes for sale to the public as mutual funds through the Credit Window of banks, which would be accomplished in the following 60 days.

C. Results

1. Federal and State Debt Reduction

It would be unwise to simply redeem all the outstanding Treasuries through the seigniorage created during the Transition, so these can be reduced as they come due and the spare funds put into a sovereign wealth fund, etc. The portion of the seigniorage allocated to the States can be used to reduce debts.

2. Deficit Reduction

The annual seigniorage created by the Monetary Commission amounts to about 2.5% of GDP which is about $425B (calculated for a $17T GDP) plus the reduction of interest payments on $16.5T in Treasuries at a long term average of at least 2.5% comes to about another $425B. The combination of these two at $850B per annum would quite handily cover the recently seen deficits indefinitely.

3. Further Results [17]

- Significant reductions in taxes but not Treasury income

- Depository bank collapses become impossible (short of fraud) and bank operations would be transparent with full disclosure

- Government guarantees of banks would not be needed any more so taxpayers would no longer be threatened [18]

- Business cycle highs and lows significantly reduced

- No more deleveraging economy

- Depository banking system regulation becomes largely autonomous

- Money creation through new monetary policy becomes steady, predictable, accountable, and effective

- Investments driven by savings and not "high powered money" creation

- Enhance economic performance (one of the aspects econometrically determined by Kumhof and Benes

References

- Fisher, Irving, 100% Money (Adelphi Publication, 1935)

- Douglas, Paul and Irving Fisher and Frank Graham and Earl Hamilton and Willford King and Charles Wittlesey, A Program for Monetary Reform, (unpublished, 1939, copy from "LIBRARY - COLORADO STATE COLLEGE of A. & M.A."), Foreword

- Benes, Jaromir and Michael Kumhof, The Chicago Plan Revisited: Revised Draft of February 12, 2013 http://www.imf.org/external/pubs/cat/longres.aspx?sk=26178.0

- Kotlikoff, Laurence, The Economic Consequences of the Vickers Commission, (Civitas: The Institute for the Study of Civil Society, 2012), pp. 42-48

- See United Kingdom House of Lords case of Foley v. Hill (1848), II HLC 28, per Lord Brougham (at 43-44), "This trade of the banker is to receive money, and use it as if it were his own, he becoming debtor to the person who has lent or deposited with him the money to use as his own, and for which money he is accountable as a debtor. That being the trade of a banker, and that being the nature of the relation in which he stands to his customer, … I cannot confound the situation of a banker with that of a trustee, and conclude that a banker is a debtor with a fiduciary character". http://www.uniset.ca/other/css/9ER1002.html

- 'Deposit is defined under English Law, within the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (the "RAO") at Art 5(2)

- The deposit is 'paid' to the bank on terms that are not referable to the provision of property (other than currency) or services or the giving of security, RAO Art 5(2)(b). There are some exceptions to this at sections 6 to 9AA of the RAO such as sums paid by the Bank of England, the IMF and certain regional development banks, and sums received by a solicitor in the course of his profession. However, these are exceptions recognised for the purposes of avoiding otherwise applicable regulatory requirements arising where a 'regulated person' conducts 'deposit taking activities', and not, in the context of this article, an exception to the sum of money being considered a deposit

- See Kumhof, Michael, Deputy Division Chief, Modeling Division, Research Dept., International Monetary Fund, speaking at the Federal Reserve Bank of Philadelphia, April 17, 2013, on video at http://www.interdependence.org/resources/the-31st-annual-monetary-and-trade-conference/ timeline (hr:min:sec) 1:06:10

- http://www.forbes.com/sites/abrambrown/2012/07/26/draghi-well-do-whats-needed-to-save-the-euro/

- The Economist, October 13, 2012; America's Financial System - Law and Disorder, page 83

- For discussion of the theoretical rationale of the "zero bound" and its effects on monetary policy, see Bennett T McCallum, "Theoretical Analysis Regarding A Zero Lower Bound On Nominal Interest Rates" (2000), Working Paper 7677 National Bureau of Economic Research, available at http://www.nber.org/papers/w7677

- See link, but which in general terms results in liquidity of 10X of the value of the 'assets', because bank reserves only need to be 10% of those assets.

- Paul McCulley, speaking at a conference, "How To Predict The Next Financial Crisis", Federal Reserve Bank of Philadelphia, February 12, 2013

- Quarterly Review and Outlook: Second Quarter 2013, Hoisington Investment Management Company, http://www.hoisingtonmgt.com/pdf/HIM2013Q2NP.pdf extracted from public tables at http://www.federalreserve.gov/

- Bureau of Economic Analysis – www.bea.gov

- Kotlikoff, The Economic Consequences of the Vickers Commission, pp. 42-48

- http://www.govtrack.us/congress/bills/112/hr2990

- Most of these are taken from Benes, Jaromir and Michael Kumhof, The Chicago Plan Revisited: Revised Draft of February 12, 2013 http://www.imf.org/external/pubs/cat/longres.aspx?sk=26178.0. See the Abstract as an abbreviated list of benefits.

- Kotlikoff, Laurence, Limiting Global Financial Instability with Limited Purpose Banking, paper delivered at Federal Reserve Bank of Philadelphia, 2013 http://www.interdependence.org/resources/limiting-global-financial-instability-with-limited-purpose-banking/